Update (June 21, 2021): Healthcare providers receiving Provider Relief Fund payments will have to report to the government on using such payments before certain newly announced spending deadlines. The first spending deadline is June 30, 2021, with a 90-day reporting period beginning July 1, 2021, to report on funds received in the first half of 2020. For the most recent updates on future deadlines and further guidance on Provider Relief Fund reporting, visit our Provider Relief Fund reporting page.

Update (May 7, 2020): The Department of Health and Human Services (HHS) updated the deadline for its required attestation before being deemed acceptance until at least May 24, 2020, and issued additional guidance, as discussed in a May 7, 2020 alert. Providers applying for the second $20 billion general distribution fund will still need to attest to the terms and conditions discussed below to apply for additional funds, as discussed in an April 27, 2020 alert.

The Provider Relief Fund Attestation Portal is now open, so eligible healthcare providers can accept or reject the initial funds released from the $100 billion Public Health and Social Services Emergency Fund appropriated in the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). Read on for more information about the Portal, including details providers should consider before attesting, as there is time before any action is necessary.

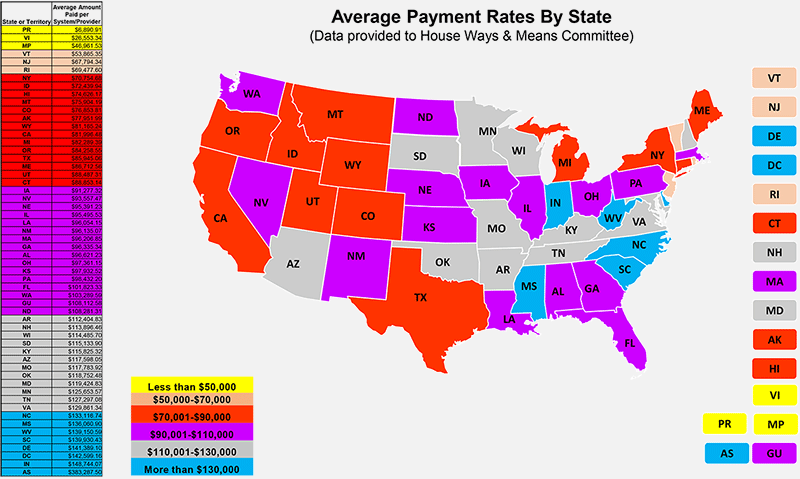

Beginning April 10, 2020, the federal government released the first $30 billion to a total of 318,168 eligible Medicare fee-for-service providers proportionately based on their share of total Medicare Parts A or B reimbursements in 2019. Using data reported by the Republican staff of the House of Representatives Committee on Ways and Means, McGuireWoods calculated the average amount paid per system and provider in that first distribution, across all 50 states and the territories. The compiled information is displayed below.

Click to view printable version of map

Since the initial release of the funds, the U.S. Department of Health and Human Services (HHS) has issued clarifications and evolving guidance about the terms and conditions of the program and has opened the Portal. HHS has directed any provider allocated a payment from the initial $30 billion released by HHS to complete an attestation confirming receipt of the payment and either (1) reject the funds or (2) accept the funds and agree to the Terms and Conditions for receiving payment. See McGuireWoods’ April 10 alert for more details on the fund and an April 14 alert on the provider terms and conditions.

Below are a few considerations for providers who have received the funds, based on updated information released by HHS.

- Timing Requirements. The funds are conditioned on the recipient’s acceptance of the Terms and Conditions, which acceptance must occur within 30 days of receiving payment. That said, HHS has stated that not returning the payment within 30 days of receipt will be deemed acceptance of the Terms and Conditions, and, therefore, there is no need to take current affirmative action if the recipient plans to retain the funds. If, however, a recipient determines it does not satisfy the Terms and Conditions or is otherwise not willing to comply with them, the recipient must reject the funds through the Portal within 30 days of receipt of payment and then remit the full payment to HHS as instructed. Because HHS’ announcements have come very rapidly, HHS has continued to issue clarifications and revisions to the Terms and Conditions. Additional guidance may be forthcoming before the end of this 30-day period.

- Attestation Process. Recipients will be required to enter the Taxpayer Identification Number (TIN) (either Employer Identification Number or Social Security number) connected to the billing entity linked to a disbursement in order to view and submit the attestation. Providers with multiple TINs will be required to list and attest to each TIN. Providers may enter up to 20 TINs.

- Attestation Terms in the Provider Portal. Recipients should be well aware of the myriad of obligations and requirements attached to the funds. The Portal details the specific attestations, as summarized in part below:

- Recipients must acknowledge receipt of the funds (the Portal will include HHS intended payment, which providers can review against what they received) and accept the Terms and Conditions (discussed in an April 14, 2020, legal alert). Recipients must also attest that they are eligible for the payment under the CARES Act. Additionally, recipients must comply with any other relevant statutes and regulations, as applicable.

- The Terms and Conditions apply directly to the recipient, but recipients should be aware that the Terms and Conditions also apply to sub-recipients and contractors under grants, unless an exception is specified. Accordingly, based on certain Terms and Conditions, providers may face limits in compensating certain employed and contracted physicians if their annual compensation exceeds $197,300 due to production-based compensation methodologies. HHS has not provided additional details regarding the expansion to cover sub-recipients and contractors under grants, or how providers can specify exceptions or calculate salary limits.

- In addition to the initial attestation, the Terms and Conditions require recipients to comply with certain reporting obligations. Though all recipients are required to submit reports “as the Secretary determines” those entities that receive more than $150,000 total funds from CARES Act and other COVID-19 response legislation are required to submit quarterly reports to HHS and the Pandemic Response Accountability Committee no later than 10 days after the end of each calendar quarter. Recipients should understand that they may be required to submit to HHS’ review process to determine the provider’s eligibility for this payment, and will be required upon HHS’ request to provide any and all information related to the disposition or use of the funds received under the relief fund for auditing and/or reporting purposes. McGuireWoods will be releasing an alert with additional information on the reporting and record-keeping requirements, but providers should plan for this reporting to require disclosing all expenses paid from these funds.

- The individual attesting on behalf of the recipient must have the legal authority to act on behalf of the recipient.

- Noncompliance With Any Term or Condition Is Grounds for Recoupment. HHS can recoup some or all of the payments made from the relief fund if a recipient fails to comply with any term or condition.

- HHS Can Make Adjustments to Payments at Any Time. Prior to using any funds, providers may wish to confirm that HHS disbursed the proper amount of funds because HHS can make adjustments at any time if a correction or change is required. As explained above, the Portal notes how much HHS intended to pay a specific TIN. HHS may take action to correct the error immediately and without notice, which may include correcting calculation and input errors and reversing improper credits. HHS reserves its right to make adjustments at any time, regardless of any limitations or time constraints, except as required by law. Providers can estimate their payment by dividing their 2019 Medicare fee-for-service payments (not including Medicare Advantage) received by $484 billion and multiply that ratio by $30 billion. Providers can obtain their 2019 Medicare fee-for-service billings from their organizations’ revenue management systems.

- United Health Group (UHG) Has Started a Relief Fund Hotline. HHS contracted with UHG to facilitate the delivery of the funds, including attestations. Recipients may contact UHG at 866-569-3522 with questions including, but not limited to, use of funds, the terms and conditions, and the attestation process.

For providers who have not yet received money from the fund, HHS will focus subsequent rounds of funding of the remaining $70 billion on providers in areas particularly impacted by the COVID-19 outbreak, rural providers, providers of services with lower shares of Medicare reimbursement or who predominantly serve the Medicaid population, and providers requesting reimbursement for the treatment of uninsured Americans.

McGuireWoods is continuously monitoring information released by HHS regarding the relief fund. Please contact the authors or any of the McGuireWoods COVID-19 Response Team members for additional information on the relief fund and its availability to healthcare providers and for assistance with the documentation and upcoming attestation and reporting process.

COVID-19: Healthcare Video Alerts

In a series of video alerts, McGuireWoods’ healthcare lawyers address issues providers face and overcoming COVID-19 challenges.